There is no universally correct way to occupy office space in London. The right model depends on a combination of headcount stability, capital availability, risk tolerance, and how quickly the organisation expects to change.

What follows is a structured comparison of the three principal occupation models, traditional lease, serviced/flexible office, and coworking, designed to help workplace decision-makers evaluate trade-offs rather than chase a single “best” answer.

The 2026 London market adds specific pressures to this decision. The Business Rates Revaluation has increased occupancy costs by up to 40% in prime districts. Grade A supply remains structurally constrained, with an estimated undersupply of around 10.8 million sq ft across the West End and City Core.

Meanwhile, flexible workspace is projected to reach 20% of London’s total office inventory by 2030, shifting from contingency solution to a mainstream component of real estate strategy. These conditions make the choice between office space options in London more consequential than it has been in recent years.

Defining the Three Office Models in London

Ambiguity around terminology is one of the most common sources of poor decision-making. These definitions draw clear lines.

Traditional lease grants exclusive possession of a defined space under a formal Deed of Lease, typically governed by the Landlord and Tenant Act 1954. The tenant holds a property interest, bears Full Repairing and Insuring (FRI) obligations, and commits to terms of 5 to 15 years.

The tenant controls all aspects of the space, fit-out, branding, security, but also assumes all operational risk, including utilisation, regulatory compliance, and exit costs (dilapidations). For teams actively searching, leased office space in London can be compared across districts and sizes.

Serviced or flexible office operates under a licence agreement, not a lease. There is no property interest and no security of tenure. The provider delivers space on a “plug and play” basis, furnished, cabled, staffed, and inclusive of utilities, on terms ranging from rolling monthly to around 12-22 months.

A subset of this category, the managed office, offers a hybrid: a bespoke, exclusively branded workspace procured and operated by a third party, typically on 18-36 month terms. It combines the exclusivity of a lease with the operational simplicity of flex. Current availability for flexible office space in London varies significantly by district and floor size.

Coworking is a membership-based model providing access to shared workspace, either as a hot desk (unassigned) or a dedicated desk (assigned) in an open-plan environment. Contracts are membership agreements with terms as short as daily or monthly. There is no private space, no exclusive possession, and minimal branding control.

Cost Comparison: Flexible Office Costs in London vs Lease vs Coworking

Directly comparing a “per desk” licence fee with a “per sq ft” lease rent leads to errors. A true comparison requires a Total Cost of Occupancy (TCO) approach, accounting for business rates, service charges, fit-out, and exit liabilities, not just the headline figure.

Flexible Office vs Coworking vs Lease in London: Costs, Pros/Cons, and When to Choose Each

The table below shows where money goes under each model. The critical difference: a lease quotes a base rent, but several large cost lines sit on top. A serviced office bundles most of these into a single monthly fee. Coworking strips the model down further, but at the expense of privacy and exclusivity.

Cost Component | Traditional Lease | Serviced / Flex Office | Coworking |

|---|---|---|---|

Pricing unit | £ per sq ft / year (NIA) | £ per desk / month | £ per membership / month |

Business rates | Paid directly to council. In 2026, approx. £40–£80+ psf in prime zones. | Included in monthly fee | Included in fee |

Service charge | £12–£20+ psf (variable, typically uncapped) | Included | Included |

Fit-out (CapEx) | £85–£150+ psf for Cat B fit-out | Zero (furnished) | Zero |

Dilapidations | £15–£35 psf (exit cost, rising under green disposal standards) | None or minimal restoration fee | None |

Hidden extras | Legal fees (£5k+), agent fees, Stamp Duty Land Tax | Meeting room overage, IT setup fees | Meeting rooms charged hourly |

Indicative 2026 price ranges by London district

Prices vary dynamically by building, floor, and availability. The ranges below are conservative estimates based on current market reporting. For specific buildings, checking live inventory through platforms like Zipcube or direct operator enquiries will give more accurate figures.

Location | Prime Lease Rent (£/sq ft) | Est. Business Rates (£/sq ft) | Serviced Office (£/desk/mo) | Coworking Hot Desk (£/mo) |

|---|---|---|---|---|

Mayfair / St James’s | £130 – £182.50 | £72 – £82 | £900 – £1,500 | £500+ |

Fitzrovia / Marylebone | £105 – £115 | £43 – £46 | £800 – £1,100 | £450 – £600 |

Victoria | £90 – £95 | £37 – £40 | £575 – £1,290 | £350 – £500 |

King’s Cross / Euston | £85 – £95 | £39 – £43 | £700 – £1,290 | £350 – £450 |

City Core (Bank) | £87.50 – £100 | £39 – £45 | £700 – £950 | £325 – £450 |

Paddington | £80 – £90 | £40 – £42 | £600 – £800 | ~£450 |

London Bridge / Southbank | £75 – £95 | £32 – £37 | £650 – £900 | £225 – £600 |

Shoreditch / Old St | £75 – £82.50 | £28 – £33 | £600 – £820 | £300 – £400 |

Canary Wharf | £50 – £60 | £15 – £18 | £400 – £600 | £200 – £350 |

For the lease columns, total cost of occupancy is rent plus rates plus service charge (£12-£20+ psf). Serviced office and coworking rates are typically all-inclusive of rent, rates, utilities, and building services.

Note the spread: a serviced desk in Canary Wharf can cost less than a coworking hot desk in Mayfair. District selection often matters more than model selection for budget-sensitive teams.

The 2026 Business Rates factor

The April 2026 revaluation has increased the “fixed” cost of leasing in prime zones by roughly £15 per sq ft compared to previous cycles. In the West End, business rates alone now run to £72-£82 per sq ft, a figure that, combined with service charges, can approach the cost of the base rent itself.

This narrows the historical cost gap between leases and serviced offices across London, particularly for teams under 30 people where the flex model’s efficiency (paying only for utilised desks) frequently makes it TCO-neutral or cheaper than a lease.

Why the per-desk comparison matters

The headline figures above are not directly comparable without adjusting for density. A traditional lease typically allocates 100–120 sq ft per person once circulation, meeting rooms, and kitchens are included. Flex operators allocate roughly 40–60 sq ft per person by monetising shared amenity space across multiple tenants.

A 20-person team leasing 2,000 sq ft at a total occupancy cost of £150 per sq ft would pay approximately £300,000 per year. The same team in a serviced private office at £1,000 per desk per month would pay £240,000 per year, a lower total cost despite a technically higher cost per square foot.

This “efficiency arbitrage” is one of the most commonly overlooked dynamics in the coworking vs office lease comparison.

Pros and Cons: Framed as Trade-offs

The following is not a scorecard. Each advantage exists in tension with a corresponding cost or constraint.

Dimension | Traditional Lease | Serviced / Flex Office | Coworking |

|---|---|---|---|

Upfront cost | High (fit-out: £85–£180+ psf) | None | None |

Long-term cost (10yr) | Lowest £ psf | 15–25% premium over lease TCO | Lowest total for small teams |

Lead time | 6–9 months | 1–3 weeks | Immediate |

Term commitment | 5–15 years (breaks at Yr 3/5) | Monthly to ~22 months | Daily / monthly |

Brand control | Total | Low (logo on door; standard furniture) | None (operator’s brand) |

Privacy | Maximum (exclusive possession) | Moderate (glass partitions; shared corridors) | Low (open plan) |

Culture control | Full | Diluted by shared environment | Defined by community, not tenant |

Compliance burden | High — tenant is statutory Responsible Person | Low — operator assumes building-level liability | None |

Balance sheet (IFRS 16) | On-balance sheet (RoU asset + lease liability) | Off-sheet if <12 mo; reducible if >12 mo | Off-balance sheet |

Scaling flexibility | Rigid (relocate or acquire adjacent) | High (right to grow/shrink, 1–3 mo notice) | Effortless (within shared format) |

Exit exposure | Dilapidations (£15–£35 psf) | Typically zero | Zero |

Key risk | Utilisation, regulatory, exit cost | Operator insolvency; rate escalation | No privacy; no brand; no exclusivity |

Operational Considerations

Scaling. Traditional leases are rigid, expansion means acquiring additional space (subject to availability and landlord consent) or relocating entirely. Serviced offices often include “right to grow” and “right to shrink” provisions, allowing desk-by-desk adjustment with 1–3 months’ notice.

Managed offices fix the footprint for the term but some operators offer portability within their portfolio. Coworking scales effortlessly but only within the shared-desk format.

Commitment and exit exposure. Lease break clauses, where negotiated, typically fall at year 3 or 5. Dilapidations at exit are trending upward, current benchmarks sit at £15–£35 per sq ft, with “green dilapidations” adding to costs.

Serviced office restoration fees should be contractually capped or eliminated (standard practice is zero). Coworking carries no exit exposure.

Compliance burden. Under a lease, the tenant is directly responsible for fire risk assessments, electrical certification (EICR, PAT testing), HVAC servicing, and legionella testing. In serviced and managed models, the operator assumes this liability.

For organisations without a dedicated facilities management resource, this transfer of responsibility can represent material time and cost savings.

Balance sheet treatment. Licences under 12 months are generally treated as off-balance-sheet service contracts. Longer serviced agreements may require capitalisation under IFRS 16, though the service component (cleaning, reception, utilities) can often be separated from the rent component, reducing the capitalised liability relative to an equivalent lease.

When Each Model Tends to Make Sense

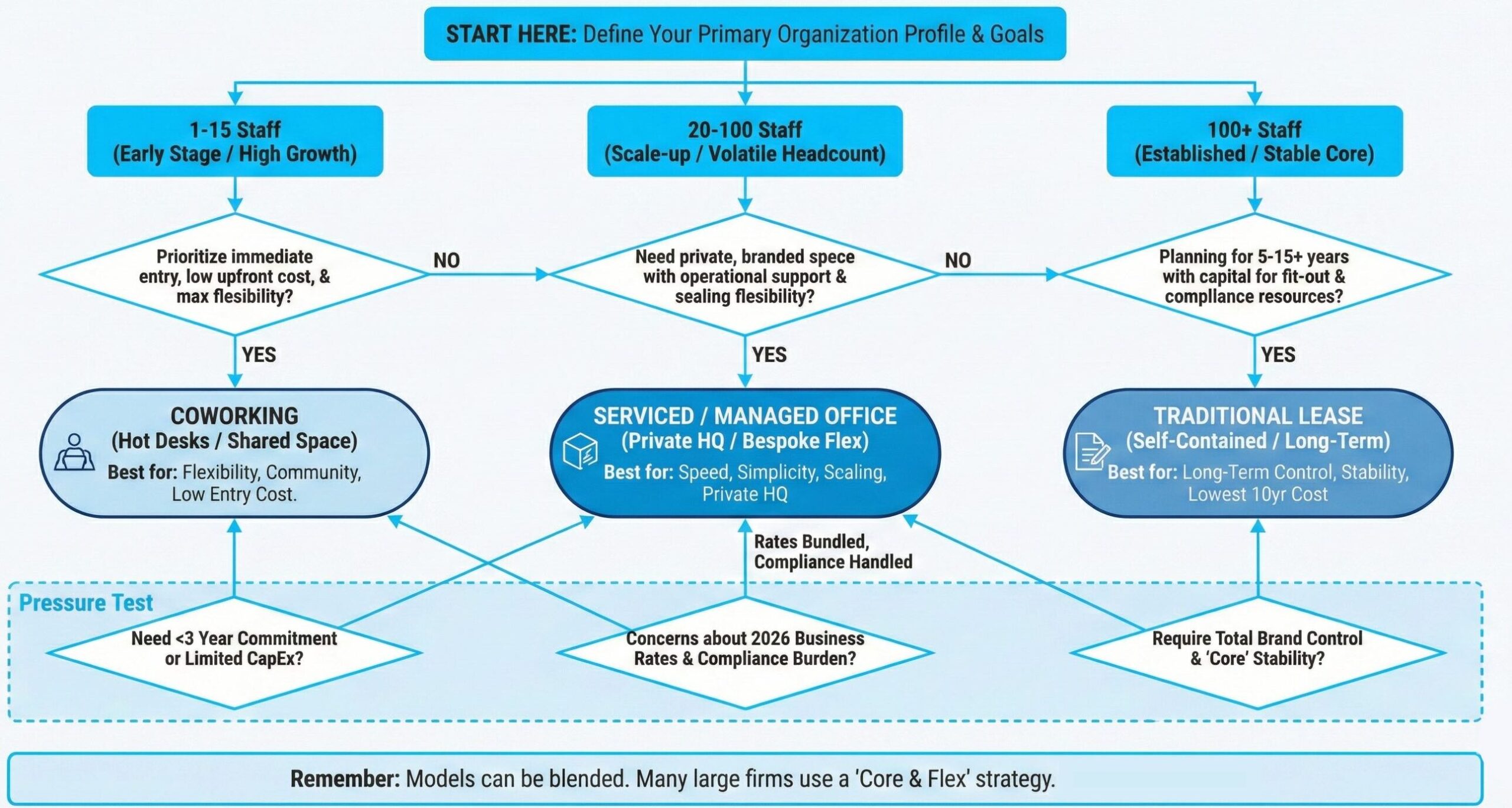

These are patterns observed across the market, not prescriptions. The right model depends on team size, growth trajectory, cash position, and how long the organisation needs the space.

When to choose a flexible or serviced office

Scale-ups and high-growth firms (20–100 staff) frequently gravitate toward managed offices. Headcount volatility following funding rounds makes fixed leases risky, but the need for a distinct, branded environment outweighs what coworking can deliver.

The managed model also avoids creating long-term lease liabilities that can complicate M&A or IPO due diligence. At roughly 50 staff, the per-desk economics of a managed office typically become more favourable than serviced equivalents.

Project and swing-space requirements (defined 12–18 month durations) are also best served by short-term serviced offices, particularly given the current wave of green retrofits forcing tenants out of older stock for upgrade periods.

When to choose coworking

Early-stage companies (1–15 staff) overwhelmingly use coworking spaces in London or small serviced offices. Cash preservation and month-to-month flexibility matter more than brand control at this stage.

The operational overhead of a lease, both financial and administrative, is disproportionate to the benefit. Coworking remains the only viable entry point below approximately £10,000 per month in Central London.

When to choose a traditional lease

Established corporates (100+ staff) often operate a “core and flex” strategy: a traditional lease covering approximately 70% of stable headcount at the lowest long-term cost, supplemented by serviced or managed satellite offices for the remaining variable headcount, project teams, overflow, and regional presence.

For organisations with stable headcount and available capital, the lease remains the most cost-effective vehicle over a 10-year horizon, provided the business can absorb the 2026 Business Rates adjustment and the upfront fit-out investment.

Top 4 Common Misconceptions

“Flexible offices are always more expensive.” On a per-square-foot basis, the headline rate is higher. On a per-person total-cost basis, the efficiency arbitrage frequently reverses this, particularly for teams under 50 people.

The 2026 Business Rates Revaluation further narrows the gap in prime districts, where rates increases of 30–40% have inflated traditional lease TCO significantly.

“A lease gives you cost certainty.” It gives rent certainty, but total occupancy cost includes business rates (subject to revaluation), service charges (typically uncapped), fit-out capital, interim maintenance, and dilapidations, all of which are variable or unpredictable.

Serviced offices, while carrying a higher headline rate, actually fix a broader portion of total cost.

“Coworking is just for freelancers.” Coworking has evolved into a legitimate component of enterprise real estate strategy, particularly for distributed teams and satellite presence. However, it remains poorly suited as a primary workspace for teams requiring privacy, client confidentiality, or cultural cohesion.

“The shadow market is a shortcut.” Subleased fitted offices appear attractive (saving £100+ per sq ft in fit-out), but typically come with rigid remaining lease terms, no service ecosystem, and “sold as seen” condition, offering limited flexibility despite lower upfront cost.

Closing Guidance

The question is not which model is best, but which combination of risk, cost, and flexibility fits the organisation’s current trajectory and planning horizon. A five-year-old company with stable headcount and available capital occupies a fundamentally different position from a post-Series B firm expecting to double in eighteen months.

The models exist on a spectrum, and increasingly, the most effective strategies blend more than one.

For teams beginning this evaluation, the practical starting point is to benchmark current options against live availability and pricing across London’s submarkets. Platforms such as Zipcube can surface what is actually on the market at a given moment, which is often more useful than relying on published averages alone.

From there, the decision should be driven by the organisation’s specific risk appetite, capital position, and operational priorities, not by market convention.